Financial flexibility and ambition for further growth

Growth in radio and marketplaces

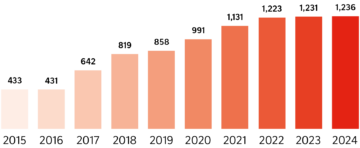

At €1.236 billion, our revenue remained virtually unchanged from 2023. Growth through acquisitions was limited. Our news media successfully continued the shift from print to digital without a significant impact on revenue. Meanwhile, advertising revenue received a boost from our radio activities in the Netherlands, and our marketplaces saw solid growth.

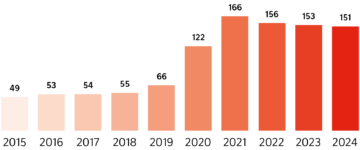

However, the sharp increase in distribution costs remains a major concern. In 2024, we were able to offset this with the effects of reorganisations and a lower, stable paper price. Due in part to the delayed impact of inflation on labour costs in the Netherlands and our investments in certain growth activities, our operating result came in at €151 million, only €2 million lower than in 2023.

The carefully calibrated pricing strategy of our news media, driven by an increasingly rich offering of journalism and services, was a key driver of our revenue. It helps our brands move toward the necessary stabilisation of margins, which remain under pressure due to rising distribution costs for print subscriptions. The termination of bpost’s service in Belgium reinforces that trend.

Despite strong international competition, our digital advertising revenue grew, with video and audio playing an important role. Our Dutch radio stations Veronica, SLAM! and 100%NL strengthened our position in the advertising market. E-commerce continues to make a solid and stable contribution, thanks to a competitive and attractive offering.

The contribution of marketplaces to the operating result increased significantly in 2024, driven by the growth of Zimmo in Belgium and Motion and Switcher in Ireland. Additionally, our 49% stake in the Dutch Automotive MediaVentions venture also grew.

“With a strong focus on improvement initiatives, we are increasing our agility and resilience in a dynamic media landscape”

Increasing agility and resilience

For Mediahuis, 2024 was a stable transitional year, with few new asset additions and a strong focus on initiatives to improve our agility and resilience in an increasingly complex world. Through automation and process optimisation within the group, we further optimised our cost structure.

The group’s equity rose to €535 million after adding the annual result of €66 million. A stable asset portfolio, regular depreciation of intangible assets and a lower net debt position led to a slight decrease in Mediahuis’ total balance sheet. The equity-to-total-assets ratio increased to 45%.

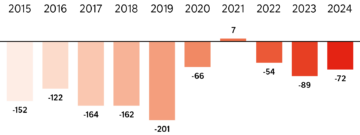

Our most significant investment in 2024 was the buyout of the minority shareholder in Medienhaus Aachen, alongside limited investments in our ventures and marketplaces portfolio. Combined with stable free cash flow, our net debt position improved to -€72 million, resulting in a financial leverage ratio of 0.37.

With a strong balance sheet and low debt levels, Mediahuis has the financial flexibility and ambition to continue growing in the coming years in a dynamic media landscape.

————————————————————————————

Recurring revenue

in millions of euros

————————————————————————————

Operating result

in millions of euros

Operating result excluding amortization of acquisition goodwill and non-recurring results

————————————————————————————

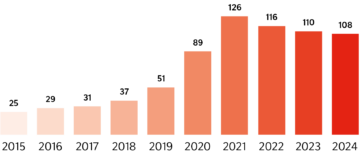

Recurring net result

in millions of euros

Operating result plus financial result (including result from investments in equity method), after deduction of corporate income tax on this

————————————————————————————

Net debt

in millions of euros

Cash and cash equivalents less bank liabilities, excluding operating lease obligations denominated under IFRS16 as debt.

————————————————————————————

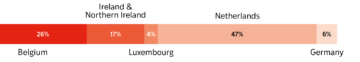

Revenue per country